Buying Adequate Insurance

One of the lessons to be learnt from the Coronavirus pandemic is the need to have adequate insurance cover. Insurance plans bring little return on investment, so we do not recommend them as optimal investment assets. However, they are essential for the protection of our wealth. Without insurance, we would need to liquidate assets to meet financial emergencies, but with insurance, our assets are preserved because the insurer pays for the emergencies. Apart from the more obvious coverage for life and health, there is now a need to consider other types of insurance protection against the emerging perils we are facing currently. Some of these additional protections may be in form of add-ons to existing policies.

Let us look at the typical life insurance policy. The policy holder contributes the premium for the stipulated time; if he outlives the contribution period, he collects the benefits, if he does not, his beneficiaries collect the benefits. But life policies now have many varieties which should be included in order to cover all the likely perils a person could face. There is the Unemployment Clause – in this instance, the Insurer would not penalize the policy holder if he is unable to pay his premium due to unemployment. In some policies, the insurer would continue to treat the policy as if premium is up to date. In other cases, the insurer pays the policy holder a monthly stipend for a stipulated period or even until he is able to find work again. Disability Clause, in this case, the insurer pays the policy holder a monthly stipend if he becomes disabled and is unable to work during the contribution phase of the policy.

Some of us have Group Life Insurance policies, which we were automatically registered for by our employer when we resumed working for the organization. For this policy, the next-of-kin registered with the HR department is automatically made the beneficiary. Some of us started working when we were single and unmarried. Have we updated our next-of-kin? Should your beneficiary continue to be your younger brother, when you now have a wife and three teenage children? Let us ensure our records are up to date both with our employer and our insurers.

Health Insurance – Some of us are blessed with jobs that provide healthcare for us and our dependents. For others, there is a need to make adequate provision for our healthcare. With the introduction of the National Health Insurance Scheme, came the Health Management Organisations HMOs. These have introduced different healthcare plans with value-added services. From as low as N3,500 per month, comprehensive healthcare can be provided for a family.

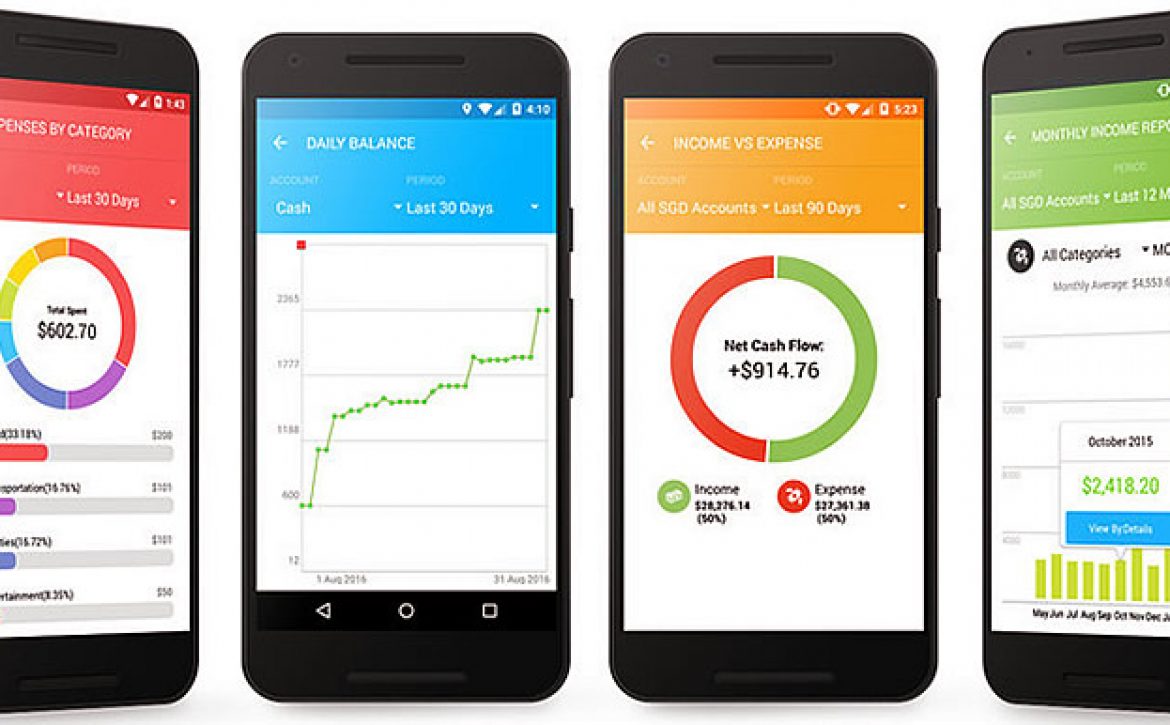

There are HMOs that provide telemedicine services that allow clients to receive medical consultations from doctors in the comfort of their homes via their mobile phones. This removes the stress of going to the hospital and waiting to be attended to. With the COVID !9 pandemic lock-down that restricts movement and also the very real risk of being infected if you go to a hospital, getting a Health Insurance policy with a telemedicine facility has become necessary.

With the easy payment models and creative value-added services, we have no reason not to provide comprehensive healthcare for our families. However, we must be careful to read what our policies cover choose the policy that meets all your family’s needs, so you are not left looking for money when medical emergencies occur.

No one can foresee untimely death but preparing adequately for dependents takes away some of the pain associated with the loss of a breadwinner. An education plan can help ensure that children get the level and the quality of education they would have received if both parents were alive. Education plans are available from investment firms, trust companies and insurance providers. A plan from an insurance company has the added benefit of full payment in the event the parent dies before contribution to the plan is complete. However, non-insurance companies have started adding that clause to their education plans. Ensure you read the fine prints to confirm that you are getting what you are paying for.

SMEs need to look at bespoke policies or add-ons that protect their businesses from today’s perils – business interruption, force majeures, supply chain failures, market failures, professional liability, workers compensation and others.

Finally, we must exercise due diligence in selecting our Insurer.And because these policies are long term (over 25 years for life policies), fresh due diligence exercises must be done periodically afterwards to confirm that the Insurer remains financially capable to protect our lives, our dependents and our wealth.

Happy Investing.